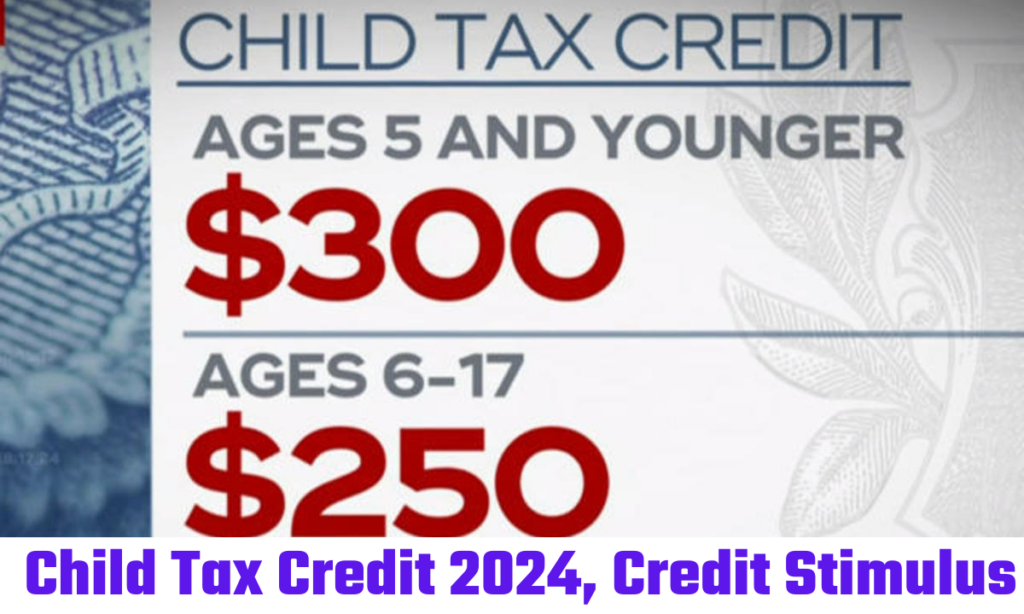

Child Tax Credit 2024 Irs Website – Here’s why you may want to wait to file your federal tax return if you’re claiming the child tax credit this year. . The bill would incrementally raise the amount of the credit available as a refund, increasing it to $1,800 for 2023 tax returns, $1,900 for the following year, and $2,000 for 2025 tax returns. The .

Child Tax Credit 2024 Irs Website

Source : cwccareers.inPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govUSA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in1040 (2023) | Internal Revenue Service

Source : www.irs.govWhere’s My Refund

Source : www.facebook.comIRS Form 2441: What It Is, Who Can File, and How to Fill It Out

When To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comChild Tax Credit 2024, Bill to Increase $700, Credit Stimulus

Source : www.csebkerala.orgChild Tax Credit | Internal Revenue Service

Source : www.irs.govWhile you can’t count on a stimulus check in 2024, here’s how to

Source : www.silive.comChild Tax Credit 2024 Irs Website $2000 State Child Tax Credit 2024 Payment Date & Eligibility News: In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was . Here’s when the 2024 tax season of those expenses. See IRS Publication 503 for the formulas. Having a child could make you eligible for the Earned Income Tax Credit. If you have one child .

]]>

:max_bytes(150000):strip_icc()/form-2441-child-and-dependent-care-expenses-definition-4783504-final-0464752338624545a391b2f2db97b354.png)